On May 14, 2025, Governor Gavin Newsom released the revised 2025-26 state budget to address a projected $12 billion deficit, a sharp contrast to the modest surplus anticipated in January. The reversal is largely driven by declining state revenues, higher-than-expected Medi-Cal expenditures, and economic uncertainty caused by newly imposed federal tariffs.

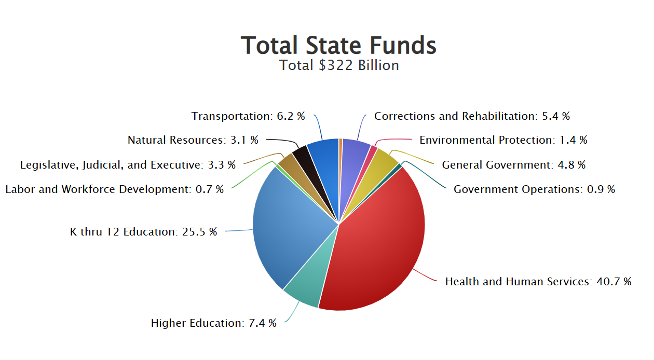

The May Revision proposes a $321.9 billion budget, which includes $226.4 billion from State General Fund and $15.7 billion in State reserve funds. Given a projected decrease in revenue, the administration is relying heavily on reductions in health care spending, particularly within the Medi-Cal program, and does not include any new investments in the health care workforce.

Key Health Care Budget Proposals:

Proposed Medi-Cal Cuts and Enrollment Changes

Medi-Cal, California’s Medicaid program, is typically funded through a partnership between the state and the federal government. However, for individuals who do not qualify for federal Medicaid funding—such as most undocumented immigrants—the federal government does not provide matching funds, even when those individuals meet income eligibility requirements.

To fill that gap, California has chosen to use state-only funds to provide certain Medi-Cal benefits to undocumented Californians. This means the full cost of coverage, services, and provider payments for these individuals is borne entirely by the state without federal matching funds. State-only Medi-Cal has allowed California to expand access to health care for populations excluded by federal policy.

However, the Governor’s proposed cuts to the Medi-Cal program—particularly those that freeze enrollment, impose monthly premiums, and eliminate key benefits for undocumented adults—undermine these goals.

Proposed Changes to Medi-Cal Coverage for Undocumented Individuals

Enrollment Freeze for Full-Scope (State-Only) Medi-Cal Expansion to Undocumented Adults– Freezes new enrollment for undocumented adults aged 19 and older, effective January 1, 2026.

Other Proposed Medi-Cal Changes and Cost Controls

Proposed Changes to Prescription Drug Coverage

Pharmacy Benefit Manager (PBM) Oversight:

To address rising drug costs and improve transparency, the May Revision proposes new statutory requirements to license and regulate Pharmacy Benefit Managers (PBMs):

Expansion of CalRx for Brand-Name Drugs:

To maintain access to essential medications, the May Revision proposes expanding CalRx to include brand-name drug purchases. This expansion would enable the state to:

Proposition 56 Reductions

California Proposition 56, also known as the California Healthcare, Research and Prevention Tobacco Tax Act of 2016, was a ballot initiative passed by voters in November 2016 to increase the tobacco tax. The revenue from this tax has been used to fund key Medi-Cal services, such as supplemental payments for family planning and reproductive health care services and dental care. Additionally, Prop 56 dollars provide funding for loan repayment for physicians and dentists who agree to a service obligation, primarily to serve Medi-Cal beneficiaries. The May revision proposes eliminating and suspending much of this funding.

No New Workforce Investments

Despite the ongoing need for a robust family physician workforce, the May Revision includes no new investments in workforce programs like Song-Brown. However, it does not cut existing investments, maintaining $109 million for the Song Brown Program, to ensure the state keeps its promise to those already awarded funding for residences and other pathways programs.

The depletion of Proposition 56 revenues and the elimination of General Fund backfill has also impacted the CalMedForce program’s ability to support existing residency programs. The state ended the General Fund backfill during the 2024-25 budget cycle, and did not allocate investments in the May revision, so the total amount of program support dropped to $24.6 million As a result, many existing programs will have to absorb the cost of previously funded residency positions, putting additional financial strain on institutions and threatening the sustainability of training pipelines in underserved areas.

CAFP is actively advocating to preserve critical workforce funding that trains and sustains family physicians across the state.

Other Noteworthy Proposals

CAFP’s Response

The California Academy of Family Physicians (CAFP) is deeply concerned about the long-term consequences these proposed budget cuts will have on our most vulnerable patients. Family physicians are uniquely trained to provide comprehensive, whole person, and continuous care from birth through end-of-life, across generations and identities—including for patients regardless of immigration status, gender identity, or sexual orientation.

Cuts to Medi-Cal and other safety net programs threaten to destabilize access to care at a time when communities need it most. Reducing investments in primary and preventive care will not save money—it will shift costs downstream, leading to higher rates of emergency department use, worsened health outcomes, and greater financial strain on our health care system.

CAFP strongly supports access to health care for every Californian. We remain committed to preserving Medi-Cal coverage, maintaining fair and timely payments for clinicians, and protecting vital workforce development programs like Song-Brown and Proposition 56 that strengthen our primary care infrastructure.

Every individual deserves care delivered in an environment of respect, collaboration, and evidence-based practice. As such, we will continue to advocate fiercely for a health system that supports the dignity and health of all people, especially those historically marginalized.